What We Do

Personal Insurance

Why have Personal Insurance?

Personal Insurances are designed to give you and your family a back-up plan.

In case something were to happen to your health and you were unable to earn an income.

Unfortunately when we can’t work because we are too sick, the bills don’t stop. The banks or power companies don’t say ‘don’t worry about it’ if you can’t work for a period of time.

There are a range of products from like Life insurance where a lump sum of money is paid on death, to Medical insurance where you can have medical tests and procedures done privately available in New Zealand.

Below we have put together a document to explain these more, please download and read through!

If you want to talk about anything further, please reach out.

Prefer to buy directly?

We understand that some people prefer to apply with providers directly either because they have done their own research or don’t have the time to meet with us.

Not a problem, below we have some direct options with insurers that you can go through without issue! The benefit? If you have a claim we are still there to help you!

Buy Insurance Products On-Line Now

Business Insurance

Why have Business Insurance?

Business insurance can be used in a multitude of ways to ensure that if something happened to your health, your business partners health or your employees health, you are covered.

If you lose your key person, you can get a cash injection to keep your business running.

If your business partner became seriously ill and needed to be bought out of the business, raising the required equity can cripple a company, insurance can be used to cover that need.

Below we have put together a document to explain these more, please download and read through!

If you want to talk about anything further, please reach out.

Employees are essential to every business

A great way to add value to an employee is having a group scheme in place, ensuring that your employees can go to a specialist if they need to without delay.

Not only does it make your employees feel valued, but helps them get the help they need quickly so they can recover properly and get back to work.

Below we have listed a few employee schemes that we can help introduce to your business.

Insuring your Employees

Risk Management

What is Risk Management?

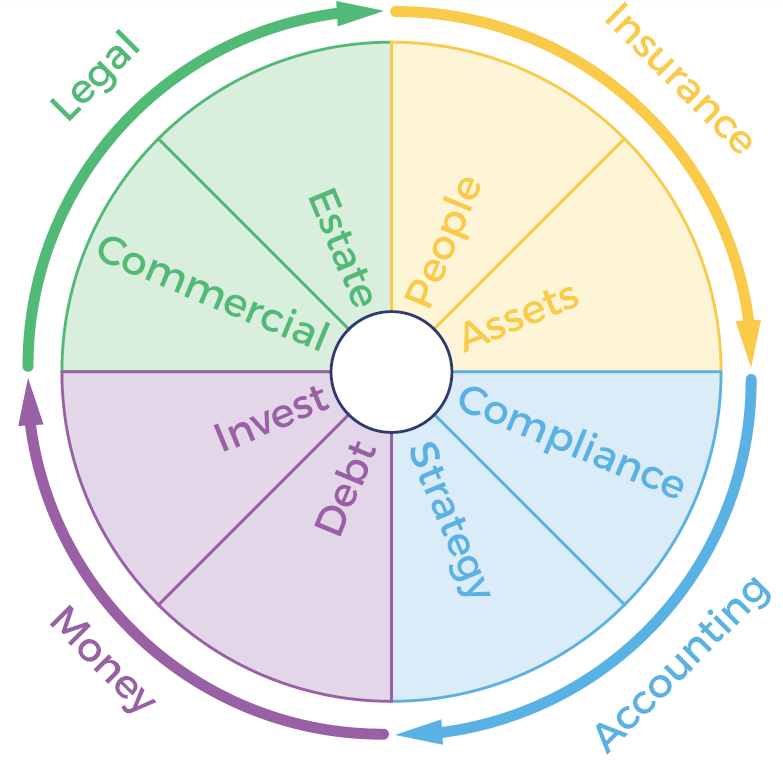

Everything comes down to structure and a well laid out plan for both good times and bad. Whilst our advisers specialise in managing the insurance needs for our clients they can also have a guiding hand in all aspects of risk management by referring clients’ needs into the areas clients wish advice in. Based on this approach, our clients look to us for assistance.

Whether you're just interested in insurance or wish a full holistic approach to risk management; we can offer many solutions for your individual situation.

Want to understand how insurances work for you and how to plan the cover you want; with professionals who are passionate about what insurance can do; working with people and who care about your goals and dreams? Then consider us to help you get the protection plan right for you. This can include working with:

Accountants

Lawyers

Mortgage Advisers

Estate Planners

Business Mentors and Coaches

Lending Experts

Wealth Creation Advisers

Investment Advisers

Insurance Companies

Bankers or

Other Experts

Providers We Work With