Insurance Affordability in New Zealand: What’s Driving the Squeeze - and What It Means for You

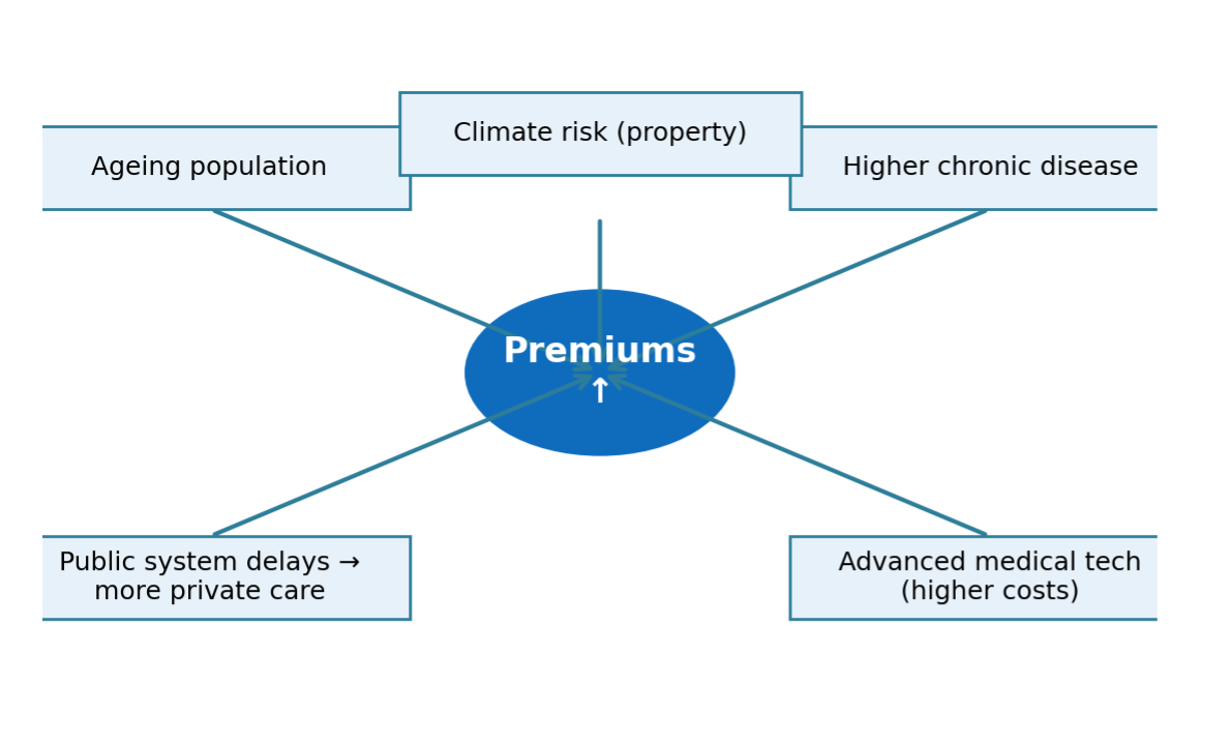

Insurance costs in New Zealand are rising rapidly across health, house, contents, and motor insurance. Medical cost inflation is forecast to remain elevated in 2026, while climate-related risks and increased claims activity are pushing general insurance premiums higher. This blog explains the key drivers, the impact on households, and practical steps to help you keep meaningful protection affordable.

Key takeaways

Health insurance premiums have seen annual increases in the 20–40% range for many policies in 2025, with medical trend projected to remain high in 2026. [1][2]

Insurance has become the fourth-highest financial pressure for NZ households, behind housing, food, and debt. [3]

Climate risk and higher utilisation of private care are major contributors to premium growth. [1][3]

Health Insurance Premium Increases (CPI) - Stats NZ Indices Reported

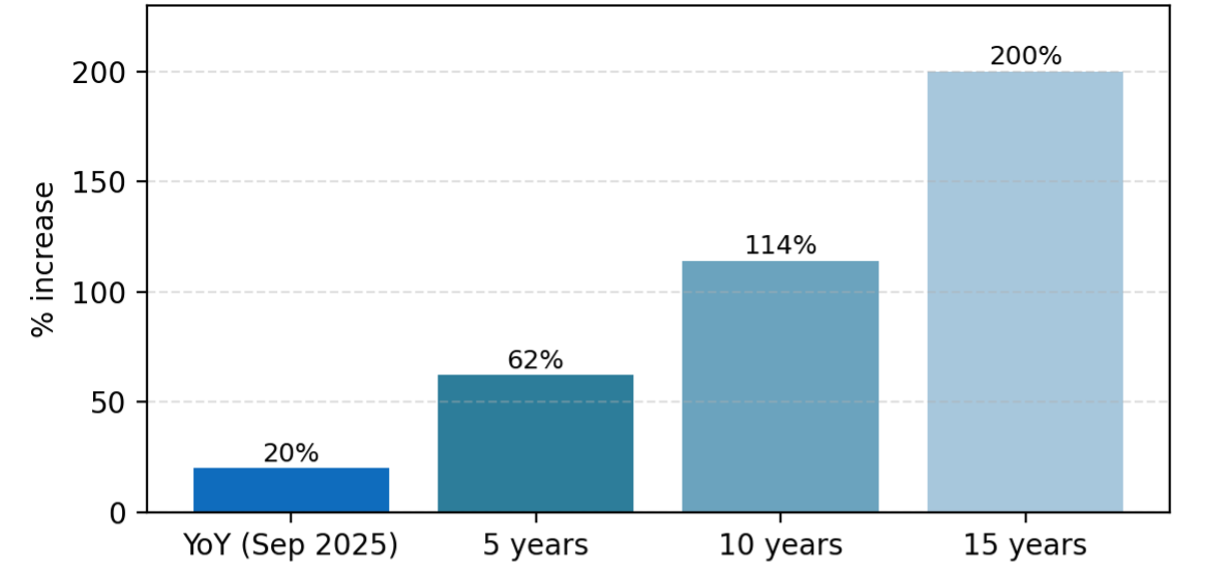

Figure 1: Health insurance premiums have risen sharply over multiple horizons. Source: Stats NZ (reported by RNZ, Oct 29, 2025). [2]

Figure 2: Key drivers pushing premiums higher across health and general insurance. [1][3]

How Rising Premiums Impact Households

Budget pressure: Insurance now ranks among the top household financial strains. [3]

Coverage gaps: Some consumers are reducing benefits or cancelling policies altogether, increasing risk exposure. [2]

Access: In high-risk areas, property cover can be more expensive or difficult to secure. [3]

What You Can Do Now

Review your cover annually: Remove duplicate benefits and ensure your policies match your current needs.

Optimise excesses: Increasing your excess can reduce premiums without sacrificing core protection.

Consider group or employer schemes: These can offer stronger terms and pricing. [1]

Stay with continuous cover where possible: Cancelling and rejoining later can leave conditions excluded. [4]

Lean on advice: Policy wording and market shifts are complex—an adviser can help you find value.

Ready to take control of your cover?

Book a free, no‑obligation insurance review. We’ll streamline your policies, remove duplication, and balance affordability with protection—so you only pay for what you truly need.

Contact Glen Hatcher | Phone: 021 684-130 | Email: glen@nvi.nz | Web: https://www.nvi.nz

References

[1] Aon 2026 Global Medical Trend Rates (summary via Insurance Business: New Zealand healthcare costs projected to climb in 2026).

[2] RNZ (Oct 29, 2025): Health insurance premiums up ~20% YoY; +62% (5y), +114% (10y), +200% (15y).

[3] Consumer NZ (May 28, 2025): New Zealanders have rising concerns about insurance costs; climate risk affecting affordability.

[4] Finergy (2025): Premium increases and considerations when switching or cancelling health cover.

Glen Hatcher

Financial Adviser

New Vision Financial Services

Plan your future and let us help you have peace of mind along the way.